Blog & Insights

A Quiet Year for Rates and Property Prices in 2024

Expect a lot of speculation on one further rate rise in February and even possibly the following review. The RBA will certainly be keen to keep speculation active, as they want consumers to remain cautious with their spending. But it is now quite unlikely that there...

Underquoting Still Rampant in Real Estate

Despite a crackdown announced in September 2022, underquoting is still widespread in Melbourne. This is despite Consumer Affairs (CAV) having issued fines of over $1 million over the 15 months since they activated a taskforce to target offenders. At $11,000 per...

Property Depreciation

Do you realise that significant tax deductions are available on older properties, not just new ones? A recent publication shows that even for homes built pre-1987, the average claimable deduction is over $5,000 in the first year. There is a popular misconception that...

The Effect of the State Budget on Property

It was with disappointment that we observed the announcements in this week’s budget that are targeted at “multiple” property owners in Victoria. Whilst we view this super-tax on investors as unreasonable and excessive, the Government has gotten itself in significant...

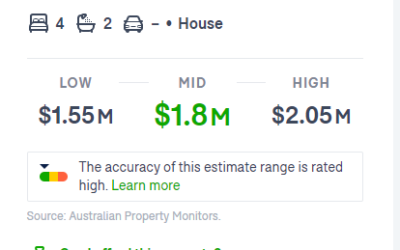

Why Automated Valuations Can’t Be Trusted

Auto price valuations or estimates are becoming quite common. Their widespread use on sites like realestate.com.au (REA), realestateview, Domain and even CoreLogic give the impression of providing reliable advice. It isn’t. Whilst a useful tool to provide a very broad...

Property Price Slide Slowing – But When Will It Turn?

We haven’t hit bottom yet and there’s still more to come. But there are signs the fall won’t be as long or far as predicted. We’ve seen the predictions of drastic falls. Almost all economists are clustered around 20% from top to bottom this cycle. Some even 30- 40%....

Sleepwalking Into a Crisis

Residential rents are currently rising and will continue to do so. Affordability is plummeting and government policy is actively making it worse. Affordable housing has become something of a hot topic for governments and there have been some laudable actions taken by...

Queen Elizabeth: Simply A Magnificent Person

With the death of the Queen yesterday, it is worth pausing to pay respect to this example of selflessness. In this new world of ME, she will be missed for the example and sacrifice she lived. It is likely that many won’t truly appreciate the stability and cohesiveness...

Property Prices & Activity

The summary version? Both are going down. No real surprise there. But the recent REIV* figures are a bit of a surprise. The monthly price index (you’d need to be a statistician to understand the formula) is showing a rapid drop. The latest report released today...

What Has Happened To Property Prices (and where are they going)?

As noted in a recent blog post, auction clearance rates in Melbourne have slid quickly. For some strange reason, the REIV persists with reporting that it is still sitting in 65%+ (67.7% for June). This is closer to 50% when ALL results are included, rather than...

Auction Clearance Rates Are Down (A Lot)

First-up, no, the clearance rates in Melbourne are not currently hovering around 70%, as the REIV misleadingly reports. It is currently below 60% and has been now since May, as more accurately reported by Corelogic*. The distortion is caused by the REIV conveniently...

May You Live in Interesting Times

Whilst not the Chinese curse it has been thought to be, this quote neatly sums up the dilemma we currently face in not just Australia, but the world today. With war, blockades, weaponization of currency and commodities and climbing inflation, we are all starting to...